TABLE OF CONTENTS

- Goodwill meaning in accounting

- Components that contribute to goodwill

- How to calculate goodwill

- Accounting treatment of goodwill

- Goodwill impairment and its impact

- Goodwill vs. other intangible assets

- Why goodwill matters in financial analysis

- Negative goodwill and bargain purchases

- How goodwill impacts business decisions

- Limitations and criticisms of goodwill

- What you need to remember about goodwill

When one company acquires another, the deal will most likely include more than just physical assets and liabilities. Intangible qualities – like brand strength, customer loyalty, good employee relations, etc. – can also have a role on influencing the final purchase price. While they might be hard to quantify, these elements still hold real value. In accounting, this value is captured through a concept known as goodwill.

Goodwill is something you’ll see come up in financial reporting, particularly during mergers and acquisitions. It can impact your company’s balance sheet and future cash flows, so getting to grips with what goodwill entails can help you plan for the future.

Goodwill meaning in accounting

In the accounting world, goodwill is an intangible asset that comes up when one company acquires another for more than the fair market value of its physical assets and liabilities. Put another way, goodwill is the premium paid over the net fair value of the target company.

Here’s an example: let’s say Company A buys Company B for $10 million. However, the fair market value of Company B’s identifiable assets minus liabilities is $7 million – that means the $3 million above the purchase price is recorded as goodwill.

Goodwill takes into account intangible benefits like brand recognition, intellectual property, proprietary technology, loyal customers, a strong corporate culture and good business processes. These elements can all contribute to a company’s ability to generate future cash flows, but they can’t be sold independently or even measured easily.

It’s important to distinguish goodwill from other intangible assets. While licences, trademarks, and patents can be sold or valued separately, goodwill can’t. It’s unique to the acquisition itself and is not amortised. Instead, it’s annually reviewed for impairment under accounting standards.

Components that contribute to goodwill

- Company’s brand: A strong reputation or established brand recognition can make a business more attractive to acquirers.

- Customer base: A loyal, long-standing customer base is generally a sign of recurring revenue.

- Good employee relations: Talented staff and low turnover improve operations.

- Intellectual property: While some IP can be separately identified, its embedded value in overall operations can also factor into goodwill.

- Proprietary technology and processes: Specific tools and streamlined internal processes add strategic value.

Although not tangible or separately listed, these things might justify paying a premium above the net fair market value of the company’s assets and liabilities.

How to calculate goodwill

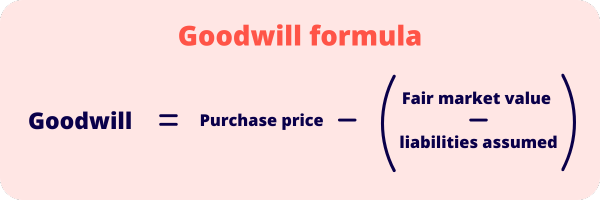

You can calculate goodwill using a really simple formula:

Goodwill = Purchase price − (Fair market value of identifiable assets − Liabilities assumed)

To break it down:

- Purchase price: The total consideration paid by the acquiring company.

- Identifiable assets: Things that can be individually recognised and valued (e.g. property, equipment, accounts receivable, patents).

- Liabilities assumed: Debts or obligations the acquiring company takes on as part of the deal.

Example of goodwill calculation

Let’s say Company ABC acquires a smaller competitor for $20 million. The fair market value of the target company’s identifiable assets is $15 million, and the liabilities assumed amount to around $3 million. In this scenario, the net fair value would be $12 million.

Goodwill = $20 million – ($15 million – $3 million) = $20 million – $12 million = $8 million

This $8 million is the goodwill that Company ABC will record on its balance sheet.

Accounting treatment of goodwill

Once recorded, goodwill shows up on the acquiring company’s balance sheet as a long-term intangible asset. It’s not classified under current assets because it doesn’t provide any immediate economic benefit.

Unlike other assets with a finite useful life, goodwill is considered to have an indefinite life and is therefore not amortised. Instead, it’s tested for impairment at least every year, or more regularly if there are signs that its value might have declined.

Goodwill impairment and its impact

Impairment is when the carrying value of goodwill is higher than its fair value, which can happen for a number of reasons:

- Declining revenue or profitability of the acquired business.

- Deterioration in market conditions.

- Loss of major customers or contracts.

- Adverse changes in legal or economic environments.

When an impairment arises, the company needs to write down the value of goodwill on its financial statements. In other words, it turns into a loss on the income statement and a reduction in total assets on the balance sheet.

Impairment example

Suppose the fair value of goodwill declines from $8 million to $5 million because of lower earnings and fewer customers. The company would report a $3 million impairment loss. This impacts:

- Net income: Reduced due to the impairment expense.

- EPS: Lower earnings per share.

- Financial performance perception: Investors might interpret goodwill impairments as a sign of overpayment or worsening business prospects.

Goodwill vs. other intangible assets

While goodwill is an intangible asset, it’s not the same as other intangibles like patents, trademarks and copyrights, which can be sold or transferred independently. They also have a finite useful life and are amortised over time, as well as being easier to quantify and value.

Goodwill, on the other hand, is only created through acquisition and has an indefinite life. It also can’t be separated from the business as a whole.

Why goodwill matters in financial analysis

When analysts evaluate a company’s financial statements, they will look at things like:

- The proportion of goodwill to total assets: A high ratio might suggest that the company regularly pays a premium for its acquisitions.

- Trends in goodwill impairment: Frequent or large impairments could indicate poor acquisition decisions or overestimated future cash flows.

- Changes in goodwill value: Can impact net income, residual equity, perceived value, etc.

In valuation models, goodwill also plays a part in metrics like enterprise value and can affect a company’s reported assets and liabilities.

Negative goodwill and bargain purchases

Sometimes, a company acquires another business for less than its net fair value, which results in negative goodwill (or bargain purchase gain), which is recorded as income on the acquirer’s income statement.

Negative goodwill happens in distressed sales where the target company is underperforming or eager to sell quickly. As an example, if the purchase price is $10 million and the fair value of net assets is $12 million, the $2 million difference is negative goodwill and would be recognised as a gain.

How goodwill impacts business decisions

Goodwill can have an effect on more than just financial reporting. It can also influence the:

- Acquisition strategy: Understanding the components that create goodwill helps buyers figure out whether a premium is justified.

- Valuation of an entire business: Companies with high goodwill balances might have a strong reputation or customer loyalty.

- Investment analysis: Investors look at goodwill levels to gauge the company’s acquisition history and see if there might be any risks tied to overvaluation.

Limitations and criticisms of goodwill

- Subjectivity: Goodwill relies on estimates of future cash flows, which are inherently uncertain.

- Impairment discretion: Companies have flexibility in impairment testing, which can result in delayed recognition of losses.

- Lack of resale value: In the event of insolvency or business failure, goodwill has no resale value and is likely to be written off.

- No direct cash benefit: Unlike current assets, goodwill doesn’t convert into cash or inventory.

As a result of these challenges, some accounting boards have debated returning to goodwill amortisation to make reporting more predictable.

What you need to remember about goodwill

At the end of the day, goodwill is an intangible asset that speaks to the value a business will acquire beyond its physical assets and identifiable liabilities. It considers things like brand strength, loyal customers, and operational know-how, which all feed into a company’s earnings power. Calculated as the excess of the purchase price over the fair market value of net assets, goodwill is recorded on the acquirer’s balance sheet and tested for impairment every year.

Most importantly, while goodwill reflects real business value, it also carries its own set of limitations. It’s not a physical asset, it can’t be sold independently, and it might need to be written down if its value declines. But as long as you understand how goodwill works, you can make smarter decisions around acquisition strategies and how a company is performing.

See related terms

What are expenses?

What is amortisation?

What is net income?