TABLE OF CONTENTS

- How to calculate EBITDA

- Breaking down the EBITDA calculation

- EBITDA vs net income: What’s the difference?

- Why is EBITDA useful for small businesses?

- EBITDA margin for evaluating profitability

- Limitations of EBITDA

- EBITDA and company valuation

- Example: EBITDA in practice

- What you need to remember about EBITDA

EBITDA stands for earnings before interest, taxes, depreciation, and amortisation. It’s a helpful financial metric used by small business owners, investors, analysts and others to figure out the financial health of a company, as well as its operational performance.

Think of EBITDA as a way to get a clearer view of your company’s profitability. It does this well by excluding non-operating expenses like interest payments, income taxes, depreciation and amortisation expenses, all of which can heavily influence net income but don’t necessarily show the company’s true operational efficiency.

How to calculate EBITDA

EBITDA is a variation of operating income calculated using a very simple formula:

EBITDA = Net income + Interest expenses + Tax expenses + Depreciation expense + Amortisation expense

Breaking down the EBITDA calculation

- Net income (net profit) is your total revenue minus all expenses (including operating costs, interest, taxes, etc.).

- Interest expenses are costs incurred from debt financing – like loans or overdrafts.

- Income taxes are the taxes payable based on your company’s profits.

- Depreciation and amortisation expenses account for the reduction in value of tangible (capital assets) and intangible assets (like patents or trademarks).

EBITDA vs net income: What’s the difference?

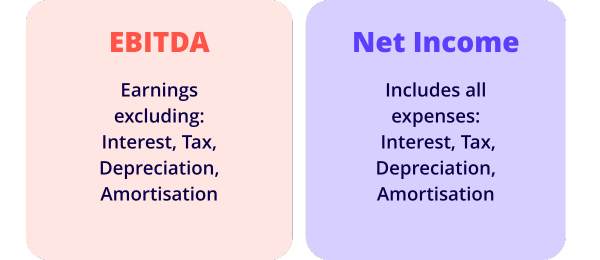

It’s true that both EBITDA and net income measure your business’s profitability, but they will give you quite different perspectives:

- A company’s net income accounts for all expenses, including non-cash items, financing costs, taxes and more.

- EBITDA excludes these elements and instead is used to provide insights into your company’s operational profitability, which can make it easier to compare companies across the same industry.

As an example, let’s say two companies in the same industry have a similar operating profit but differ in net income because of different financing structures or tax rates. EBITDA helps strip away these variables to reveal their underlying profitability and operating income.

Why is EBITDA useful for small businesses?

EBITDA gives small business owners a clearer snapshot of a company’s financial health by looking into their core activities. By removing costs outside the company’s control, like tax rates or financing costs, owners can more accurately determine and compare operating profit over time.

Small businesses with positive EBITDA are generally seen as financially healthier since it suggests their core operations generate sufficient earnings to cover costs before financing and tax obligations. It also helps confirm whether or not the company can service debt and attract investors.

EBITDA margin for evaluating profitability

The EBITDA margin is another valuable metric derived from EBITDA. Here’s what it looks like:

EBITDA Margin = EBITDA / Total Revenue × 100

Companies with a higher EBITDA margin usually have lower operating expenses than their revenue. In other words, their operations are more efficient.

Limitations of EBITDA

Although EBITDA is highly valuable, it does have its limitations.

- Excludes cash flow: EBITDA doesn’t represent actual cash available, as it ignores changes in working capital and capital expenditures needed to maintain or grow operations.

- Doesn’t reflect asset depreciation: Excluding depreciation means that EBITDA can overstate profitability, especially for asset-intensive businesses that need ongoing capital investments.

- Ignores financing costs: Companies with heavy debt might show strong EBITDA but face struggles with cash flow and financial risks due to high interest payments.

To counteract these limitations, businesses can use adjusted EBITDA (normalised EBITDA) to factor in one-off or unusual expenses and gains. This is a smart way to get the clearest possible picture of ongoing financial performance using this metric.

EBITDA and company valuation

Some business owners use EBITDA to figure out the enterprise value of their company. Investors also regularly apply an EBITDA ratio (or multiple) relevant to the industry to estimate a company’s valuation. No matter what stage of business growth, a company that generates higher EBITDA can attract higher valuation multiples, making it more attractive for potential buyers or investors.

Example: EBITDA in practice

Let’s consider two companies in the same sector:

| Metric | Company A | Company B |

|---|---|---|

| Total revenue | $1,000,000 | $1,000,000 |

| Interest expenses | $50,000 | $0 |

| Tax expenses | $100,000 | $120,000 |

| Depreciation and amortization expense | $80,000 | $100,000 |

| Net income | $770,000 | $780,000 |

| EBITDA | $1,000,000 | $1,000,000 |

Despite having different net incomes thanks to differences in tax and financing structures, both companies show identical EBITDA, which is a sign of equal operational profitability.

What you need to remember about EBITDA

EBITDA can give you some handy insights into your business’s profitability by looking at core operations and excluding costs like interest, taxes and asset depreciation. You can compare operational performance across different businesses and help determine the overall financial health and enterprise value of your business.

However, EBITDA shouldn’t be the sole measure of your company’s success – it should always be considered alongside other financial indicators (e.g., net income and cash flow statements) to provide a complete picture.

At the end of the day, the best way to understand your operational efficiency and profitability is to use multiple metrics in tandem with one another. Otherwise, you’re only getting half of the whole story.

See related terms

What are expenses?

What is amortisation?

What is net income?