Tax is a mandatory financial charge that governments charge both individuals and businesses in Australia. The intent is that these taxes generate revenue that pays for public services, infrastructure, and various other everyday needs of a functioning society.

While no one likes paying them, taxes are an integral part of modern economies, and they help fund the essentials like healthcare, education, defence, and emergency services. Paying taxes is a civic duty and a way to protect the economic stability of our country.

Tax (definition)

In simple terms, tax is a financial charge levied by the government on individuals, businesses and a number of other entities with the goal of raising funds for government revenue. Taxes are collected by federal, state and local governments to raise revenue and finance public activities and services, including infrastructure projects, social welfare, disaster relief and much more.

There are two main types of taxes in Australia, known as direct tax and indirect tax.

Direct taxes

Direct taxes are taxes imposed directly on income, profits or property. Examples include:

- Income tax: Paid by individuals and businesses on their taxable income.

- Corporate tax: Levied on company profits.

- Property taxes: Taxes on land and real estate.

Indirect taxes

Indirect taxes are taxes levied on goods and services rather than income or profits. Examples include:

- Goods and Services Tax (GST): GST is a consumption tax applied to most goods and services.

- Excise taxes: Levied on things like fuel, alcohol, tobacco and more.

How taxes work in Australia

In Australia, we operate on a progressive tax system. All this means is that people with higher incomes pay a higher proportion of their earnings in income taxes. The federal government, via the Australian Taxation Office (ATO), is the primary authority for collecting taxes, but state and local governments also collect taxes like payroll taxes, stamp duty and property tax.

Why do we pay taxes?

So, why do we pay taxes? They are used to:

- Fund public services: Including hospitals, schools, public transport and aged care.

- Support economic growth: Investing in infrastructure and capital investment projects.

- Pay for welfare and emergency services: Such as pensions, disaster relief and unemployment benefits.

- Finance government activities: Like national defence and law enforcement.

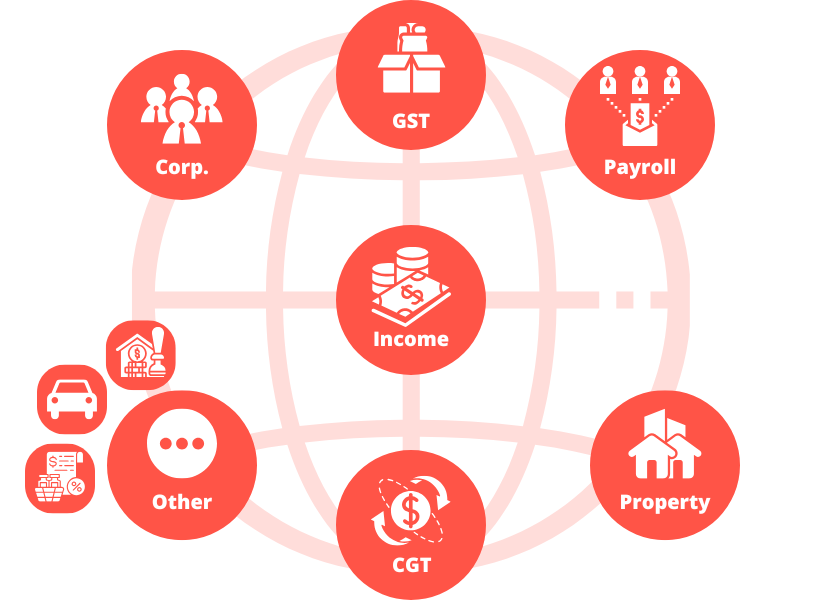

Types of taxes in Australia

1. Income tax

Income tax is the big source of tax revenue in the country, and it applies to both:

- Individuals, based on their taxable income (i.e. wages, salaries, investment returns).

- Businesses, through corporate income taxes on profits.

Income tax rates are progressive, with higher earners paying a larger percentage. For example:

- Income up to $18,200 is tax-free under the tax-free threshold.

- Taxable income above $190,000 attracts the highest marginal tax rate.

2. Corporate tax

Companies operating in Australia are subject to corporate taxes on their profits. The standard corporate tax rate is 30%, but small businesses can qualify for a reduced rate of 25%.

3. Goods and services tax (GST)

The GST is a 10% value-added tax applied to most goods and services sold in Australia. Businesses registered for GST collect this tax on behalf of the government.

4. Payroll tax

This is a state and territory tax imposed on employers when their total wages exceed a certain threshold. The rates and thresholds for payroll taxes vary from state to state.

5. Property taxes

There are a few different types of property tax, including:

- Council rates: Charged by local governments based on the assessed value of a property.

- Stamp duty: A one-time tax on property purchases (e.g. when you buy your first home).

- Land tax: An annual tax on landowners. However, this is excluded for primary residences.

6. Capital gains tax (CGT)

If you make a profit from selling an asset, such as real estate or shares, then you’ll have to foot the bill for CGT. It’s considered part of income tax and applies only to the capital gains, not the total sale price.

7. Other taxes

- Excise taxes, which are applied to alcohol, tobacco and fuel.

- Luxury car tax, which is levied on imported cars above a certain value.

- Inheritance tax. While in Australia, you won’t be stung by an inheritance or estate tax in the traditional sense, some superannuation death benefits may be taxed.

How to calculate taxable income

Taxable income is the income amount used to calculate your tax liability. It includes earnings from employment, investments and business profits.

You can calculate your taxable income in three easy steps:

- Add up your total income.

- Subtract any eligible deductions (e.g. work-related expenses, donations to charities).

- Apply the relevant tax rates to figure out your tax payable.

Alternatively, get your accountant to take of it for you.

Lodging your tax return

Every individual and business in Australia needs to lodge a tax return annually to report their income and taxes paid up to that point. The ATO uses this information to figure out whether any additional tax is owed or if a tax refund is due.

Steps to lodge your tax return

- Gather up all your income statements, receipts, records and other relevant documents.

- Use myTax or a registered tax agent for simplicity, or submit a paper return.

- Lodge your return by 31 October unless you use an agent.

The role of tax in society

At the end of the day, taxes are what support economic growth and help maintain equality in a country like Australia. Redistributing wealth through social programs means that taxes actually end up reducing societal costs and set up safety nets for the most vulnerable in our community.

But that doesn’t mean that taxes aren’t without their controversies. Because indirect sales tax like the GST is passed onto the customer, it can disproportionately affect lower-income households. And in terms of tax policy at-large, there are ongoing debates about lowering taxes for businesses to encourage investment, but this could negatively impact the amount of revenue available for public services.

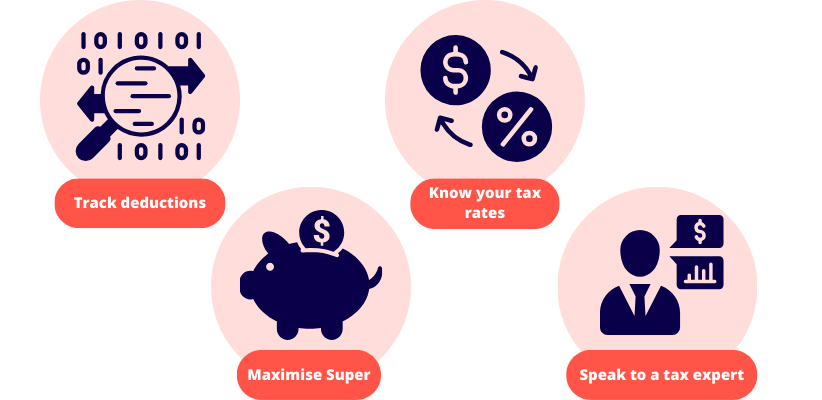

Tax tips for everyday Australians and business owners

- Track your deductions: Keep good records of all your expenses to claim the most deductions at the end of the financial year.

- Know your tax rates: Find out exactly which bracket your income falls into and plan your finances accordingly.

- Maximise your super contributions: Making extra contributions into your superannuation fund can give you tax breaks while at the same time supercharging your retirement savings.

- Speak to a tax expert: Getting professional advice will help you stay in the ATO’s good books, as well as highlight any potential opportunities for tax savings.

Whether you’re lodging a tax return, planning for retirement savings, or growing your business, make sure you spend at least a bit of time staying informed about any changes to the Australian tax system and tax brackets.