Profit margin is a tool used to found out the percentage value of how profitable a businesses is compared to its costs. Businesses use margin in a number of ways to identify areas of improvement to increase or maintain profitability.

Margin and markup should not be confused. Markup is a pricing tool businesses use to increase the selling price against the purchase price of goods sold.

Use our free gross profit margin calculator below to identify your gross profit.

Free gross margin calculator

Results

Determining your margins

To determine your profit margins, a few financial values need to be considered.

Revenue earned

Revenue is the sales of your goods or services while operating your business. Your revenue amount depends on your sales and the selling price of your goods and services. Revenue is what you bring into your business and is used to pay for operating and nonoperating costs associated with running your business. Whatever is left over is your profit.

Cost of goods sold

The cost of goods sold – commonly referred to as COGS – is the direct cost for a business to produce a good or service. These costs include:

- Cost of raw materials

- Cost of manufacturing

- Cost of labour

Other financial factors

As your review process of your profit margins gets more in-depth, other financial factors come into play. When you are conducting your operating margin or net profit margin, the scope changes and includes other costs associated with running a business:

- Expenses (all the costs related to operations and non-operations)

- Interest on debt

- Tax liabilities

- One-off revenue generation

These financial factors aren’t necessary when calculating a small business’s gross profit margin. Still, if you need to assess your small business at higher levels, such as an operating or net profit margin, you’ll need to have these figures.

Different margin types

There are three different types of margins that businesses use to assess the profitability of operations at various levels:

- Gross profit margin

- Operating margin

- Net profit margin

Each margin has a particular function or scope businesses use to review specific operations.

Gross profit margin

A gross or sales margin is a simple approach to determining a business’s costs at face value. It gives a snapshot of your goods and services and how they perform directly with the costs involved in producing them with COGS.

While it isn’t as in-depth as a net profit margin, a gross profit margin helps you evaluate your selling prices and whether adjustments need to be considered.

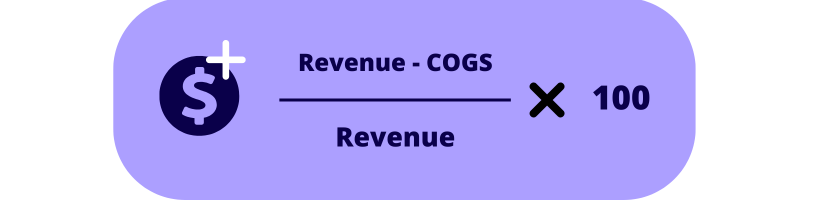

Gross profit margin formula:

To calculate your gross profit margin, you will first: subtract your cost of goods sold (cogs) from your total revenue, divide this figure by your total revenue and multiply by 100. The resulting percentage will be your gross profit margin.

Operating profit margin

Businesses use the operating margin matrix to gain further insight into overall profitability compared to overall operating expenses. This is a higher level of investigation, as the resulting percentage will provide context on whether current operations are profitable.

Operating margin includes wider expenses such as administrative expenses, wages and salaries, marketing, and depreciation.

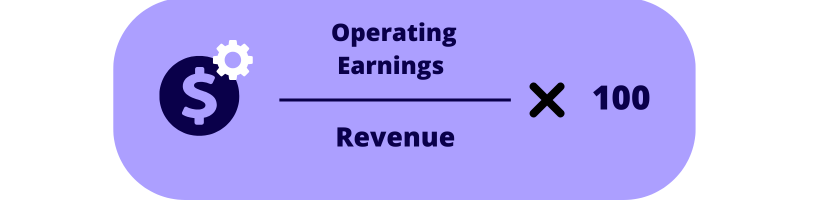

Operating profit margin formula

To calculate your operating profit margin, operating expenses and COGS are added together and subtracted against your revenue. The result will return your operating income, which you divide by your total revenue and multiply by 100 to return a percentage for your operating profit margin.

Net profit margin

Net profit margin is the most extensive measurement of profitability against all costs associated with running a business, both operational and non-operational. This includes interest paid, other income streams, and taxation.

Net profit margin is commonly referred to as your business’s ‘bottom line,’ and the net margin percentage will show investors, shareholders, and creditors whether your business is profitable.

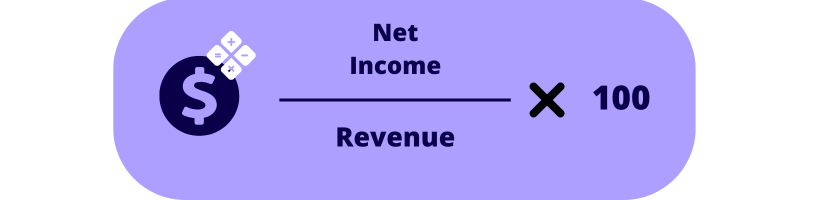

Net profit margin formula

To calculate your net profit margin you minus operating expenses + COGS + interest on debt and tax liabilities from total revenue. You divide the resulting figure (net income) by total revenue and return the figure as percentage by multiplying by 100. The resulting percentage will be your net profit margin.

Good profit margin by industry

There is not one benchmark profit margin that businesses follow. Many businesses fall into industries with different margin thresholds determining their profitability.

For example, the profit percentage of the supermarket industry is lower, between 1-3% as net profit, whereas the finance and insurance services industry has a higher profit margin at 25.3%.

Whatever industry you operate in, as a small business owner, using margin is a great way to evaluate your operations and identify areas for improvement so that you can remain profitable.