A receipt is a document – either physical or digital – that’s used in any type of business transaction. Ultimately, it’s what acts as proof that a payment was made for goods or services. It includes details of the purchase itself and is essential for bookkeeping, refunds, or warranty claims.

Whether it’s a digital receipt, a GST tax invoice, or a handwritten note, a receipt formalises the exchange between a buyer and seller. In other words, it’s the customer’s evidence of their purchase.

What is a receipt of payment?

A receipt of payment is a formal acknowledgment from a business that money was received in exchange for goods or services. Customers receive the receipt as a document that should include details such as the date and amount paid, as well as a description of the product or service provided.

Receipts don’t have to be physically printed on paper. On the contrary, you can create receipts as itemised bills that can come in the following forms:

- Cash register docket: Most commonly used in retail stores and supermarkets.

- Hand-written document: Useful for small or informal transactions, such as listing the hourly rate and services of hiring a tradesperson.

- Digital receipt: Sent via email or SMS for online or in-store purchases.

- GST tax invoice: For purchases subject to the Goods and Services Tax (GST).

Is a tax invoice the same as a receipt?

While a tax invoice and a receipt aren’t exactly the same thing, they have a few similarities. A tax invoice is needed when GST is involved, as it will show the amount of GST included in the price.

A receipt, on the other hand, is a broader term that simply confirms a payment was made – it could be anything from online sales that include a reference number to box office receipts for a show you’ve paid to see. It might even include a production number linked to a specific item that’s been paid for.

Here’s an easy trick: all tax invoices can be receipts, but not all receipts are tax invoices, especially if they don’t include GST details.

Why must businesses provide a receipt?

In Australia, businesses are legally required to give a receipt for any purchases over $75. For transactions below this amount, the customer can request one if needed – and the business must provide it. Receipts are important because they:

- Act as the customer’s proof of purchase.

- Clearly outline the details of the transaction.

- Help customers track their spending.

- Allow businesses to maintain accurate records (e.g. a food and beverages supplier keeping all receipts in in dedicated manufacturer’s database).

Why is a proof of purchase important for repairing, replacing or refunding?

Because a receipt is the customer’s ‘proof of purchase’, it’s essentially evidence that they are entitled to a warranty or return. That means if there’s ever a need to request a repair, replacement or refund for a product or service, this document confirms that the transaction did indeed occur at the specified business.

Without proof of purchase, it’s easy for disputes to arise over whether the item was truly bought from the store in question or when the purchase took place, which makes it very difficult to claim warranty or consumer rights.

That’s why for both consumers and business owners, keeping good records of your receipts can save time and headaches during product returns or repairs.

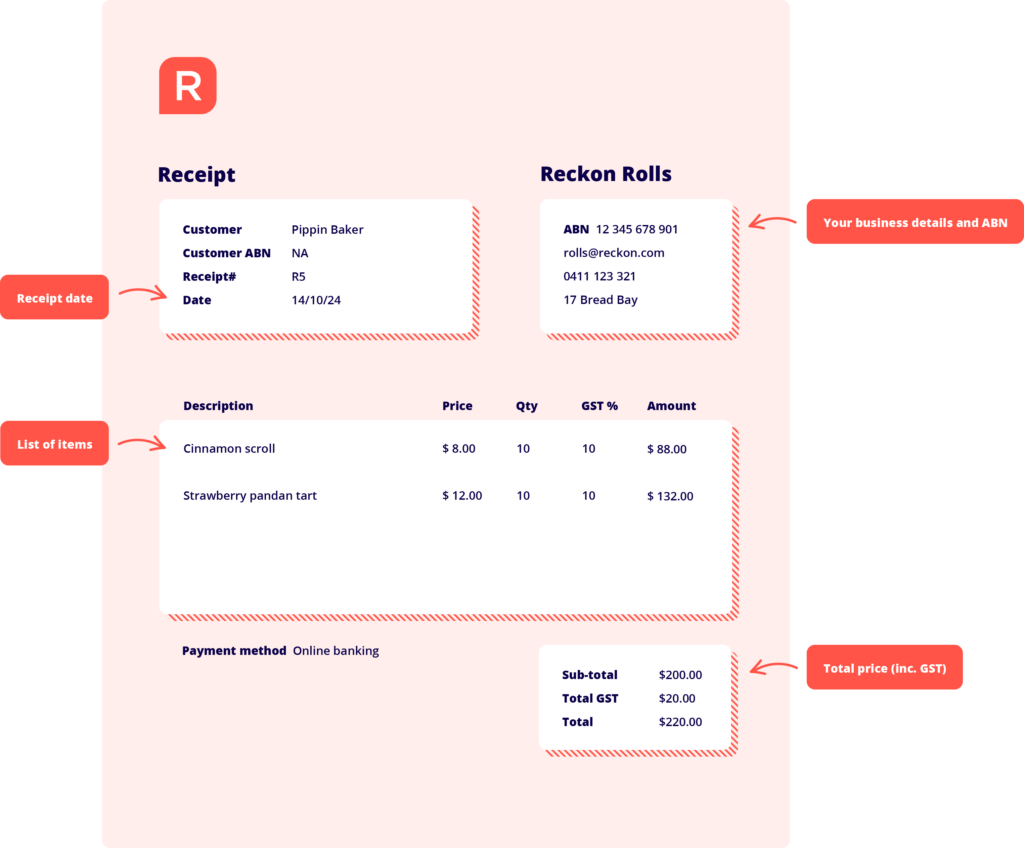

How is an itemised bill formatted?

An itemised receipt breaks down the purchase into smaller segments, making it easier to understand what was bought and at what cost. Legally speaking, receipts need to include the following:

- Business name: Identifies the seller.

- Business’s ABN or ACN: Their official registration information.

- Product or service: Describes what was sold (and may include extra details like labour hours or the manufacturer’s details).

- Date: Indicates when the transaction took place.

- Price: Shows the total amount paid, including any taxes that were applied.

Example of receipts

Here’s a simple example of what a receipt might look like:

Receipts are more than just proof of payment – they’re a key part of running a business. For customers, they are also necessary for consumer rights and warranty claims. Whether it’s printed on a piece of paper or emailed as a digital receipt, receipts help make the business world go round.