Electronic funds transfer, or EFT, is Australia’s most widely used transaction system. Since 2007, its use has outpaced cash transactions, with the bulk of transactions being made with debit cards. While some still think “cash is king,” Australians make over 55 million electronic transactions a day because of the reliability of EFT payments.

Here is what you need to know about electronic funds transfer and how it is relevant to small businesses.

What are Electronic Fund Transfer payments?

Electronic funds transfer, or EFT, is when you transfer money electronically from one account to another. The backend of a single EFT payment and what makes it possible are complex, but the main takeaway is that the transaction is electronic.

For example, OSKO is one of the most popular transaction methods for bank deposits among financial institutions. All Australian banking institutions use OSKO as part of the New Payment Platform policy, allowing secure funds transfer between accounts. If you have moved your money through different bank accounts or to another individual, it was most likely done using OSKO.

This is just one of the many ways we use EFT in Australia. Let’s examine the most widely used types.

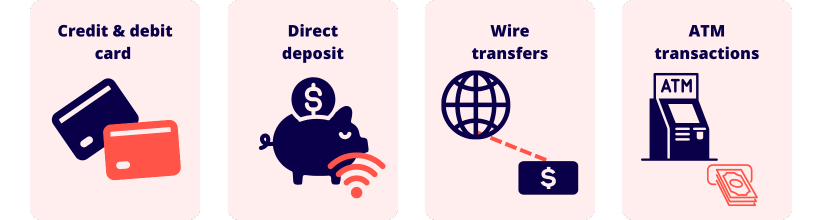

Types of EFT payments in Australia

Electronic funds transfer is the underlying system that makes these transfer and transaction methods work.

Credit or debit card transactions

Credit and debit cards are the most widely used payment systems by Aussies to transfer funds between accounts and pay for things.

Debit card transactions are electronic payments made by transferring funds directly from one bank account to the recipient.

Credit card payments involve an EFT transaction based on the available line of credit you have been lent.

Direct deposit and bank account transfers

Direct deposits are one of the most common transactions you can do. Essentially, you move a certain amount of money (bank transfer) to another bank account. This can be moved from one financial institution to another or the same. The ease and use of direct deposit make it popular among individuals, businesses, and government institutions.

Wire transfers

Wire transfers are similar to direct deposits, as you transfer money from one account to another. However, the difference is that wire transfers generally have high service fees because they are one-off payments. You typically use this type of EFT payment for international transactions or large cash transfers.

ATM transactions

ATM transactions allow individuals and businesses to turn their cash into electronic funds as needed. You deposit your money into your bank account by making an electronic funds transfer (EFT payment) or vice versa and withdraw cash from your account.

Why do businesses use EFT payments?

EFT payments are part of broad payment systems that allow modern society and business to function. It would be impractical to carry out business transactions without the EFT component. That being said, as there are many methods of EFT to choose from, it’s important to use certain payment systems that suit your business as part of your procedures.

For instance, a coffee shop or cafe would use electronic funds transfer at point of sale (EFTPOS) as the most efficient and cost-effective payment system for customers on the go who need their coffee quickly. Another example is the commercial online secure payment service Paypal, which is being utilised by e-commerce businesses. An e-commerce business would use PayPal to provide a secure payment gateway for EFT payments so customers can easily purchase goods and products from their website.

Pros and cons of EFT payments

EFT allows for great flexibility and efficiency when making a transaction or transfer. Let’s examine its pros and cons.

Pros of EFT payment

- Speed and convenience: The time it takes for funds to transfer between accounts makes EFT efficient, as there are little to no time constraints.

- Security: EFT payment systems have a great deal of procedure and security built into them to minimise theft.

- Records: Any transaction made will be recorded instantly once made. This can also minimise double handling, where you can import your transactions into accounting software for your business.

- Added value: Having diverse payment options allows you to increase revenue for your business.

Cons of EFT payment

- Hard to reverse transactions: If you made a transaction in error, you may find it challenging to fix. This is especially true for wire transfers, as they cannot be reversed.

- Target for scams: Due to our reliance on EFT payments, bank accounts are the prime target for scams. Scammers will try to trick or coerce people into giving out financial details.

- Reliance on the Internet: EFT payments are electronic, so these processes cannot be done without the Internet.

How to make EFT payments work for your small business

The best way to incorporate EFT payments into your business is to research and apply a product that makes sense to you and your customers. If you’re in hospitality, use EFTPOS services to quickly take customer payment details and upload them to your bank account.

Alternatively, if your business is entirely online, you can use online payment services to take card payments from customers who shop on your website.

Ultimately, you want to ensure your business is set up correctly to accommodate most payments and increase revenue. You can account for this if you have dedicated accounting software to record your incoming and outgoing electronic payments.