A pro forma invoice is a nonbinding informal invoice much like an estimate. Proforma invoices are not considered an official invoice (formal invoice sent between a supplier and purchaser).

A pro forma invoice represents a ‘good faith estimate’ of items, shipping costs, contact details and payment terms.

Pro forma invoices should not be used for accounting purposes as they are considered a preliminary bill, not a binding agreement.

What is in a pro forma invoice?

Unlike commercial invoices, where you would have all the details associated with the purchase of an item, a pro forma invoice is like an estimated invoice. The details within a pro forma invoice generally include some or all of the following:

- Include the terms that stipulate that this document is not a forma invoice

- selling price

- Quantity

- Delivery timeline (approx.)

- shipping costs

- payment details

- contact details

- billing address

- applicable terms

How to create a pro forma invoice

To create a pro forma invoice, you can use a template of one of your invoices and edit the document to stipulate that it is a pro forma invoice. Typically, you should be able to use your accounting or invoicing software to produce it.

The benefits of pro forma invoices

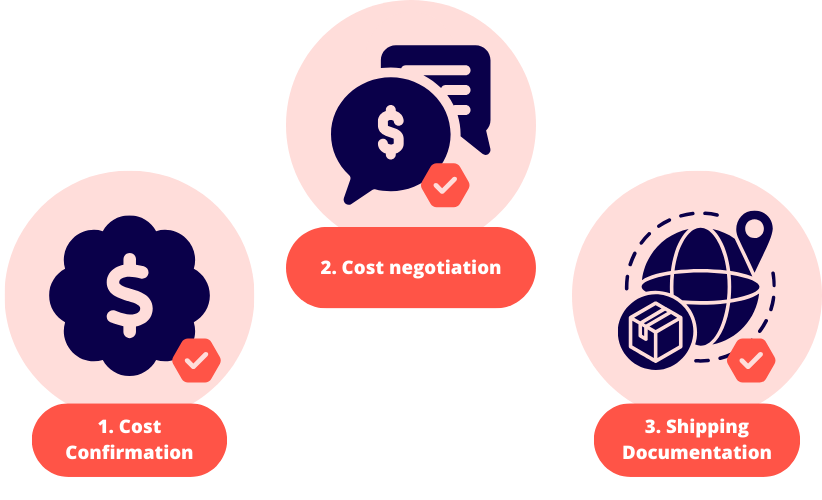

1. Confirmation of costs

The benefits of using pro forma invoices are that they represent an estimated cost to the purchaser and are considered a handshake or informal agreement between engaging parties.

2. Negotiation of costs

A pro forma invoice can also present an opportunity for parties to negotiate terms found in this informal document. A pro forma invoice is considered a more professional version of a quote and is used as such.

It should be noted that this is not to be confused with a purchase order, as these are considered a financial document, and the price is fixed.

3. Shipment and customs details

During the sales process, before an actual commercial invoice is used, when two interested parties contact each other, a pro forma invoice gives the purchaser an idea of the costs involved.

These documents can sometimes accompany shipped items to indicate what the purchaser should expect to see represented in the final invoice. It can also assist international trade, as some countries reject imported items without proper identification and supporting documentation.

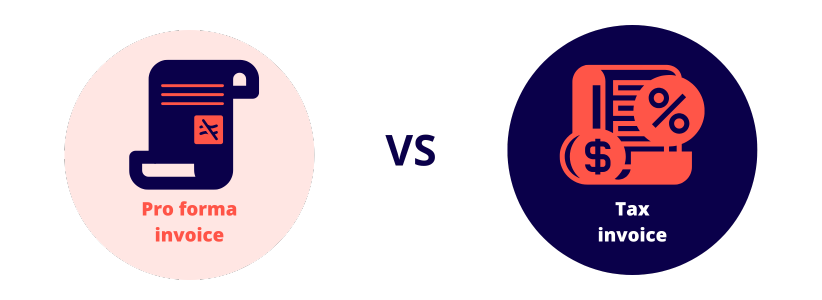

Pro forma invoice vs tax invoice

Now that we know what a pro forma invoice is, how is it different from a tax invoice? A tax invoice is the final sales invoice used for a payment request and represents the tail end of a transaction.

The key difference between the two is that a tax invoice is a legally binding agreement with detailed information like an invoice number, applicable taxes such as GST, and payment process details. When a customer pays, they will use the tax invoice.

A pro forma invoice represents an initiation of purchase and is non-binding, and a tax invoice represents the finalisation of a binding transaction.

Can a pro forma invoice be cancelled?

A pro forma invoice is not binding, so you don’t need to cancel it as you haven’t engaged in payment terms at this stage. A customer simply change their mind and tell the other party they are not interested. A pro forma invoice should be seen as a potential arrangement and ballpark estimate of a transaction transaction.