TABLE OF CONTENTS

Let’s explore why we use remittance advice as part of the payment process.

Is remittance advice proof of payment?

Remittance advice is not proof of payment; it is a notification that payment is going to a supplier. Remittance, on the other hand, is the act of paying an invoice.

While it isn’t a required part of your business procedure, there are worthwhile reasons why businesses should implement the practice. Sending advice to your supplier is considered best practice and benefits you and them along the lines of communication, efficiency, and your reputation. Let’s have a look.

Why send remittance advice?

Remittance advice is not compulsory, so why do businesses still use it? Remittance advice serves multiple purposes, including informing the invoicing process and the business’s conduct.

Remittance advice as a form of ongoing communication

Remittance advice notes and slips communicate that you are sending immediate payment to your supplier, client, or other business affiliate. It lets those who do business with you know that they will get their payment soon.

It keeps things above board with your suppliers. If something were to happen between receiving supplies and pending payments, you would be able to cross-reference certain documents, such as invoices, purchase orders and remittance advice slips, to remedy issues.

For example, say that you have sent remittance advice for a shipment of raw materials to your warehouse. This notification to your supplier has reminded them of the upcoming shipment they will be filling out. The supplier would have missed the shipment if you had not sent the remittance advice. While this is a simple example, it reinforces that communication is part of a functioning business.

Remittance advice and payment processing

Besides good business communication, remittance advice also helps with your internal bookkeeping and accounting systems. Your accounts receivable department or accounting team would use remittance advice as a financial document that signifies payments they should be looking for.

You will also be better prepared and more efficiently able to process your financial records when you anticipate incoming payments.

Remittance advice is good business procedure

Remittance advice is good business practice. It keeps you transparent and informs your suppliers that you’re a reliable business partner. Basic remittance advice can go a long way for your business’s reputation.

It also sets standards within your business procedure. Although it may seem unnecessary, having solid business systems in place decreases the chance of manual errors and lets you track how far along a project is.

Remittance advice slip example

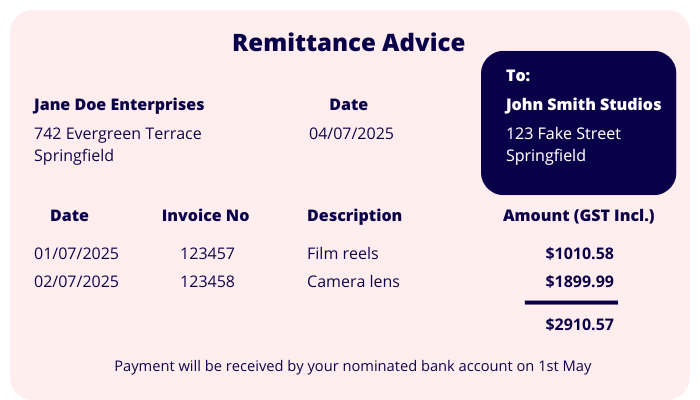

When you send remittance advice, your note should contain:

- The buyer’s company name and address

- Your company name and address

- Payment date

- Invoice number

- GST (if applicable)

- payment amount

- The goods or services paid for

Any additional details can be added if required, but a remittance advice should be short and succinct. For example, here is a remittance advice template:

Remittance advice template

Remittance advice and your business

Consider sending remittance advice as part of your business procedure. While it isn’t necessary, it is a standard courtesy that many companies adopt. Adding that extra step to your processes is one way to making your business seem more reliable and also have proper internal procedure.