Fringe benefits tax (FBT) is a tax employers pay on top of a non-salary or wage benefit they provide to their employees. FBT is a complicated tax system, so it is important that businesses know what they are liable for if they offer fringe benefits.

What is the fringe benefit tax?

Fringe benefits tax is applied to benefits other than salary and wages. The ATO considers fringe benefits part of a salary packaging arrangement. FBT is reported separately from taxable income. The Australian Tax Office (ATO) has an extensive list of fringe benefits on its website.

Let’s look at what are considered common employee fringe benefits.

Types of Fringe Benefits Tax

Many types of benefits are considered taxable:

- Using a company car for private use

- Gym memberships

- Certain entertainment expenses (i.e. holiday packages over $300)

- Tuition and school fees

- Providing loans or discounted loan fringe benefits

- Providing benefits under a salary sacrifice arrangement

What are not fringe benefits?

- Salary and wages

- Employer contributions to super

- Shares or options provided under an employee share acquisition scheme

- Employee termination payments

- Volunteer and contractor benefits

- Payments deemed as dividends in accordance with Division 7A

How fringe benefit tax works

Employers are liable to pay fringe benefits tax (FBT) because it is a tax on certain benefits that they give to their employees, their employees’ families, or other associates. When an employee receives a fringe benefit, the employer must determine the FBT amount payable.

FBT is in place to collect tax revenue on non-salary and wage benefits. Before FBT was introduced, businesses could reduce their employees’ income tax by providing these benefits. For example, if you paid an employee around 1000 dollars a week, you would withhold around 255 dollars in tax to send to the ATO. If the business had paid their employees’ mortgage instead, no tax would have applied to the employee who would otherwise have paid. FBT stops this type of practice.

How are fringe benefits taxed?

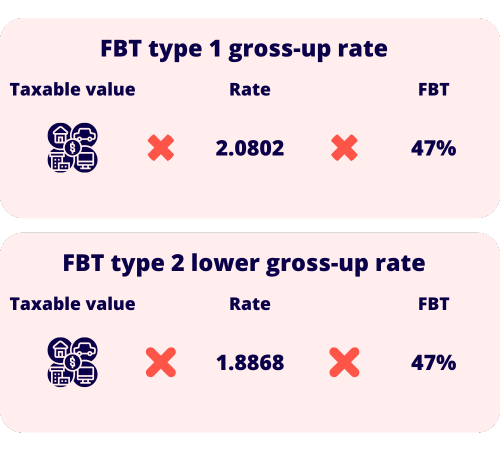

Fringe benefits are applied to the taxable value of the fringe benefit, which is determined via two mechanisms:

- The highest income tax threshold of 45% plus the medicare levy surcharge of 2% (47%)

- The type of gross-up rate applicable

The gross-up rate applied comes in two types:

- Type 1: Gross up rate of 2.0802

- Type 2: Lower gross up rate of 1.8868

The type of gross-up rate applied is determined by whether the benefit provider (business/business owner) is entitled to a GST credit when purchasing the benefit. For example, if a business buys a gym membership for its employee and the purchase is subject to GST, the business is entitled to a GST credit, and then the Type 1 gross-up rate is applied.

Type 2 is applied when no GST credit is applicable.

To work out your FBT liability, you would find:

- The reportable fringe benefits amount (the taxable value of the goods and services benefit)

- Multiply the amount by the grossed-up type

- Multiply this figure by the 47% tax rate

To calculate your fringe benefits, you would use a formula like this:

Benefit taxable amount x grossed up rate x 47%

That said, there is a lot involved in figuring out your FBT obligations, and it is important that you use the right resources to calculate FBT properly.

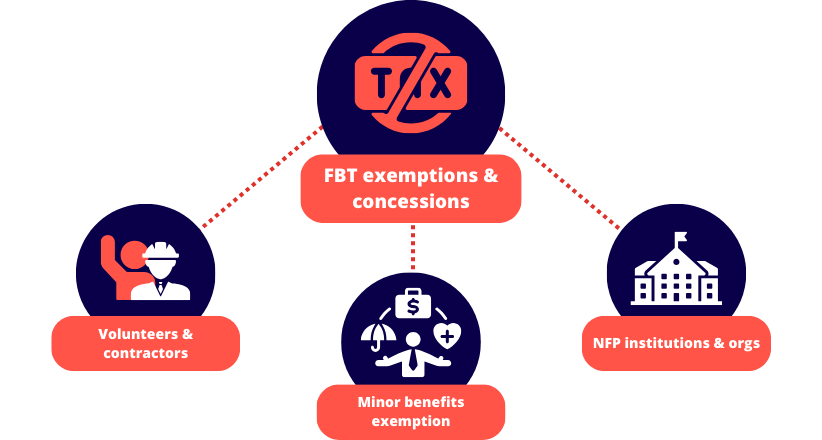

Exempt fringe benefits and concessions

FBT exemptions by institution/organisation

You must belong to a particular type of organisation or institution to receive an exemption or a capping threshold for FBT.

Not-For-Profit organisation

Not-for-profits (NFPs) receive a cap threshold for fringe benefits if they fall under the following categories: public benevolent institution, health promotion charity, public/NFP hospital, and public ambulance service.

For public benevolent institutions and health promotion charities, the cap threshold is $30,000. For public/NFP hospitals and public ambulance services, the cap threshold is 17,000.

The fringe benefits of car parking, meal entertainment, and entertainment facility expense are exempt from the capping thresholds and must be reported on normally.

Religious institutions

Religious institutions are eligible for exemption from the FBT if they provide benefits to religious practitioners (i.e. a deacon or priest), live-in carers, and domestic employees.

Religious institutions must be registered under the Australian Charities and Not-for-Profit Commission.

Volunteers and contractors

The fringe benefit tax applies to your employees, their families, and other associates for benefits provided other than salary or wages. As volunteers and contractors are not directly employed, any expenses or benefits provided are not subject to FBT.

Minor benefits exemption

The minor benefits exemption is only applicable if both of the following circumstances are satisfied:

- The benefit is less than $300 in notional taxable value

- It is unreasonable for the purchase to be treated as a fringe benefit

Notional taxable value is the value of the benefit if it were taxable. For a benefit to be considered minor and unreasonable as a fringe benefit, a series of factors need to be considered, such as:

- Circumstances of the benefit being provided.

- The frequency at which the benefit is being provided.

- Is the benefit similar to other fringe benefits you pay tax on?

- Is the benefit associated with being part of a fringe benefit?

- Difficulty in working out the value of the benefit.

A good example of a benefit that can be considered exempt is flowers purchased for an employee for a specific occasion. If the flowers are purchased as a one-off below $300, this benefit would be considered exempt under the minor benefits exemption.

When to report fringe benefits

Before you can report on fringe benefits, you need to know when the reporting period starts.

The reporting period for FBT starts on the 1st April and ends on the 31st March of the year ending.

Your payment for FBT is due on the 21st May for the previous reporting period. You must pay your FBT liability quarterly if your reportable fringe benefits amount is over $3,000. The ATO will send an activity statement to businesses that pay quarterly with lodgement dates.

When the annual reporting period arrives and you have paid your FBT liability in instalments, you can offset your annual FBT liability by the instalments made.

How to register for fringe benefit tax

To register for FBT, you can:

- Register online with the ATO business portal. An ABN is needed

- Via phone

- Via a tax agent

- Through lodgement of your FBT

For more information on how to register, you can visit the ATO website.